La Esperanza and Beyond

Yesterday we traveled to La Esperanza. Not only did we visit our Partner ODEF's office, we also visited the clients in the surrounding rural area. Here are their stories:

Maria Isabel Pineda Sanchez:

Maria has obtained three loans, her first loan was in the amount of 3,000 lempiras (divide by 20 to find the dollar amount). All of her loans were taken out for cultivating fresh vegetables: broccoli, cauliflower and cabbage. Maria is a single mother after being widowed 18 months ago. After realizing the fact that she would need to support her family she decided to take out a loan to continue the business that her husband had started. She counts on her 15 year old son and her only daughter to help her with the day to day operations. Her loan goes to the purchase of seed and fertilizer. The loan from ODEF allowed her to start a new chapter in her life. She is full of pride because she can feed her family. She expressed to us a gratitude like no other because we were the first group to come out and visit her beautiful farm.

Eustacio Gomez:

Eustacia has borrowed 4 times from ODEF totaling 35,000 Lempiras. He is a farmer and his main crop is potatoes. When we went to visit, his family of 6 was present. The little ones were all smiles and the older ones were busy working while their father answered all of our questions. We had many questions for him but one stood out because of his inspiring response. "What is the hardest part about farming and running your business?" He calmly replied that he knew that in order to get ahead and raise his standard of living he would have to face hardships. He didn't think about what was hard and what was not, he just kept moving forward in order to give his children the opportunities that he didn't have.

Senora Enemecia Gonzalez:

Enemecia started with ODEF with a loan of 4,000 Lempira for her weaving business. To date she has borrowed 5 loans in the sum of 28,000 Lempira. Her business employs 5 members of her family. Her family in total has 9 members including her daughter that is 1 year old. With her loans she has been able to purchase and build two new looms in order to keep up with increasing demand for her beautiful weaving. She really showed us the entrepreneurial spirit that microcredit has been able to help her develop.

Maria Isabel Pineda Sanchez:

Maria has obtained three loans, her first loan was in the amount of 3,000 lempiras (divide by 20 to find the dollar amount). All of her loans were taken out for cultivating fresh vegetables: broccoli, cauliflower and cabbage. Maria is a single mother after being widowed 18 months ago. After realizing the fact that she would need to support her family she decided to take out a loan to continue the business that her husband had started. She counts on her 15 year old son and her only daughter to help her with the day to day operations. Her loan goes to the purchase of seed and fertilizer. The loan from ODEF allowed her to start a new chapter in her life. She is full of pride because she can feed her family. She expressed to us a gratitude like no other because we were the first group to come out and visit her beautiful farm.

Eustacio Gomez:

Eustacia has borrowed 4 times from ODEF totaling 35,000 Lempiras. He is a farmer and his main crop is potatoes. When we went to visit, his family of 6 was present. The little ones were all smiles and the older ones were busy working while their father answered all of our questions. We had many questions for him but one stood out because of his inspiring response. "What is the hardest part about farming and running your business?" He calmly replied that he knew that in order to get ahead and raise his standard of living he would have to face hardships. He didn't think about what was hard and what was not, he just kept moving forward in order to give his children the opportunities that he didn't have.

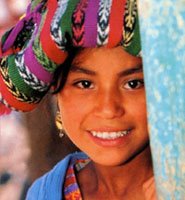

Senora Enemecia Gonzalez:

Enemecia started with ODEF with a loan of 4,000 Lempira for her weaving business. To date she has borrowed 5 loans in the sum of 28,000 Lempira. Her business employs 5 members of her family. Her family in total has 9 members including her daughter that is 1 year old. With her loans she has been able to purchase and build two new looms in order to keep up with increasing demand for her beautiful weaving. She really showed us the entrepreneurial spirit that microcredit has been able to help her develop.