Day 2

Yesterday we traveled all over the surrounding areas of Tegucigalpa to meet with a microfinance institution (MFI) as well as entrepreneurs themselves. After a 7:30 breakfast the group hopped in the vans to visit one of Katalysis' Partner MFI's, FUNED. FUNED is based in the city limits and its mission is distinctly Christian based. All of the clients that we met throughout the day were clients of FUNED. So after an overview of FUNED business practices the group got back into the vans to visit or first client of the trip. We traveled up a substantial

We traveled up a substantial

hill. After a 30 minute jaunt we arrived at a pulperia (grocery store) we were greeted by two of FUNED's loan officers. We were supposed to meet the women who was receiving the loans but due to a family emergency she had to be somewhere else. But her husband that was running the business with her was present to tell us a little bit about the how microcredit has allowed him to improve the lives of his children, expand their business and make some improvements to their home. Some interesting aspects of this particular borrower are that he has two children attending a private university and he and his wife work about 10-12 hours a day 7 days a week. There are two products that this particular pulperia sold that made it so successful: nacatamales and tortillas. People travel from all around Tegucigalpa and other nearby cities to enjoy the hand prepared food that this family provides. He even said in the past that demand for his product has come from people in the United States. He is pictured below in front of the store.

Our next trip was to a community called 28 de Octubre (28th of October). The name comes from the date that the community was founded.

Our next trip was to a community called 28 de Octubre (28th of October). The name comes from the date that the community was founded.

Within this community there was a group of women and women, that bared the same name as the community, that were part of a community bank. A community bank will receive a loan as a whole and then divide the money accordingly to the members and their businesses. So you have a strict sense of accountability as well as a close knit network of support within these groups. If one perosn defaults on their loan the rest of the group is given the task of finding a way to pay the loan back. We were invited into one of the members homes and with all of us comfortable they each explained what they did with their loans. Some sold clothes, others fruit and one of them was the neighborhood tortilla vendor. All community lending groups have a President, Treasurer, Controller and a Secretary. These positions are voted on democratically by the members of the group. This visit was definitely a highlight for the group. Below is a picture of the group.

We traveled up a substantial

We traveled up a substantialhill. After a 30 minute jaunt we arrived at a pulperia (grocery store) we were greeted by two of FUNED's loan officers. We were supposed to meet the women who was receiving the loans but due to a family emergency she had to be somewhere else. But her husband that was running the business with her was present to tell us a little bit about the how microcredit has allowed him to improve the lives of his children, expand their business and make some improvements to their home. Some interesting aspects of this particular borrower are that he has two children attending a private university and he and his wife work about 10-12 hours a day 7 days a week. There are two products that this particular pulperia sold that made it so successful: nacatamales and tortillas. People travel from all around Tegucigalpa and other nearby cities to enjoy the hand prepared food that this family provides. He even said in the past that demand for his product has come from people in the United States. He is pictured below in front of the store.

Our next trip was to a community called 28 de Octubre (28th of October). The name comes from the date that the community was founded.

Our next trip was to a community called 28 de Octubre (28th of October). The name comes from the date that the community was founded.Within this community there was a group of women and women, that bared the same name as the community, that were part of a community bank. A community bank will receive a loan as a whole and then divide the money accordingly to the members and their businesses. So you have a strict sense of accountability as well as a close knit network of support within these groups. If one perosn defaults on their loan the rest of the group is given the task of finding a way to pay the loan back. We were invited into one of the members homes and with all of us comfortable they each explained what they did with their loans. Some sold clothes, others fruit and one of them was the neighborhood tortilla vendor. All community lending groups have a President, Treasurer, Controller and a Secretary. These positions are voted on democratically by the members of the group. This visit was definitely a highlight for the group. Below is a picture of the group.

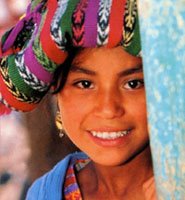

We met many amazing people and heard even more amazing stories. This type of travel is very unique and makes one feel many emotions. The people of Honduras are strong and capable people and today we saw that with access to credit lives are changing for the better. So until tomorrow I say goodbye with a little help from my friend below.

0 Comments:

Post a Comment

<< Home